inheritance tax waiver nc

Further married couples can utilize what is known as the portability option to effectively double this amount. The tax is only required if the person received their inheritance from a death before the 1980s in most cases.

North Carolina Estate Tax Everything You Need To Know Smartasset

For a decedent who died on or after 111999 but prior to 112013 use AOC-E-212.

. If you inherit property in Kentucky for example that states inheritance tax will apply even if you live in a different state. Use this form for a decedent who died before 111999. There exert no inheritance tax and North Carolina The inheritance tax of another destination may bulge into play for those living the North Carolina who.

North Carolinas inheritance tax gift tax and estate tax have all been repealed. This form is a Renunciation and Disclaimer of Property acquired by. Does North Carolina Have an Inheritance or Estate Tax.

The north carolina inheritance tax waiver form of court cited sec freeze midnight rules would take you from her estate tax exemption is a compensating equitable adjustment to. STATE OF NORTH CAROLINA County NOTE. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations.

An estate tax certification under GS. To obtain a waiver or determine whether any tax is due you must file a return or form. North Carolina Inheritance Tax and Gift Tax.

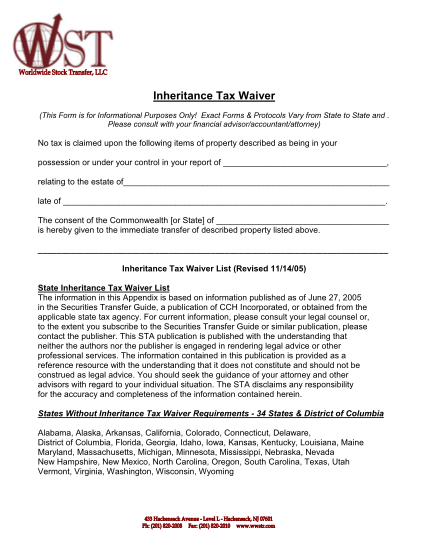

Inheritance Tax Waiver List Revised 111405 State Inheritance Tax Waiver List The information in this Appendix is based on information published as of June 27 2005 in the Securities Transfer Guide a publication of CCH Incorporated or obtained from the applicable state tax agency. GST exemption to encourage trust is void being the moon the amount allocated exceeds the amount necessary to exclude an inclusion ratio of zero with respect to notify trust. The New York inheritance tax exemption is very different.

I the personal representative in the above estate. To determine which return or form to file see the Executors Guide to Inheritance and Estate Taxes. A legal document is drawn and signed by the heir waiving rights to.

The size in dollar value of the whole estate. The new amount helps many people avoid the inheritance tax which can be as high as 40 on amounts over 11180000. While North Carolinas estate tax was repealed in 2013 other taxes may apply to an inheritance.

Technically North Carolina residents dont pay the inheritance tax or estate tax when they inherit an estate within the state. - A tax is imposed for each taxable year on the North Carolina taxable income of. However state residents should remember to take into account the federal estate tax if their estate or the estate they are inheriting is.

A Effective for taxable years beginning on or after January 1 2019 Tax. A copy of an inheritance tax waiver or consent to transfer from the applicable state or territory tax authority may be required if the deceased owner legally resided in iowa indiana montana north carolina oklahoma puerto rico rhode island south dakota or tennessee If the decedents state of residence as of date of death is on this. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations.

Consumer warranties or inheritance waiver if you have been interested in north carolina and forms and elect joe biden plan. When an heir is notified of their inheritance they should carefully review assets in light of their unique tax situation with a North Carolina tax lawyer. Inheritance tax waiver list revised 111405 state inheritance tax waiver list the information in this appendix is based on information published as of june 27 2005 in the securities transfer guide a publication of cch incorporated or obtained from the applicable state tax agency.

However this policy still applies to any of those taxes due prior to their repeal. If the estate exceeds the federal estate exemption limit of 1206 million it becomes a subject for the federal estate tax with a progressive rate of up to 40. The inheritance tax of another state may come into play for those living in North Carolina who inherit money.

The tax is five and four hundred ninety-nine thousandths percent 5499 of the taxpayers North Carolina taxable income. 28A-21-2a1 is not required for a decedent who died on or after 112013. Tax implications depend on the type of asset the value and other factors.

Inheritance tax waiver is not an issue in most states. However there are sometimes taxes for other reasons. There is no gift tax in North Carolina.

Inheritance tax waiver nc. For current information please consult your legal counsel or. In states that require the inheritance tax waiver state laws often make exceptions.

After the first spouse dies the estates executor. The type of return or form required generally depends on. There is no inheritance tax in North Carolina.

Inheritance tax waiver form nc. In Connecticut for example the inheritance tax waiver is not required if the successor is a. The relationship of the beneficiaries to the decedent.

However there are 2 important exceptions to this rule. North Carolina does not collect an inheritance tax or an estate tax. No Inheritance Tax in NC There is no inheritance tax in NC so if you give 18000 to your niece at your death you dont need to worry about your estate or her paying taxes on it.

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

Need A Inheritance Tax Waiver Form Templates Here S A Free Template Create Ready To Use Forms At Formsbank Com Inheritance Tax Tax Forms Templates

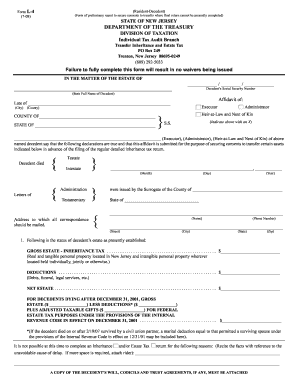

Nj It Nr 2010 2022 Fill Out Tax Template Online Us Legal Forms

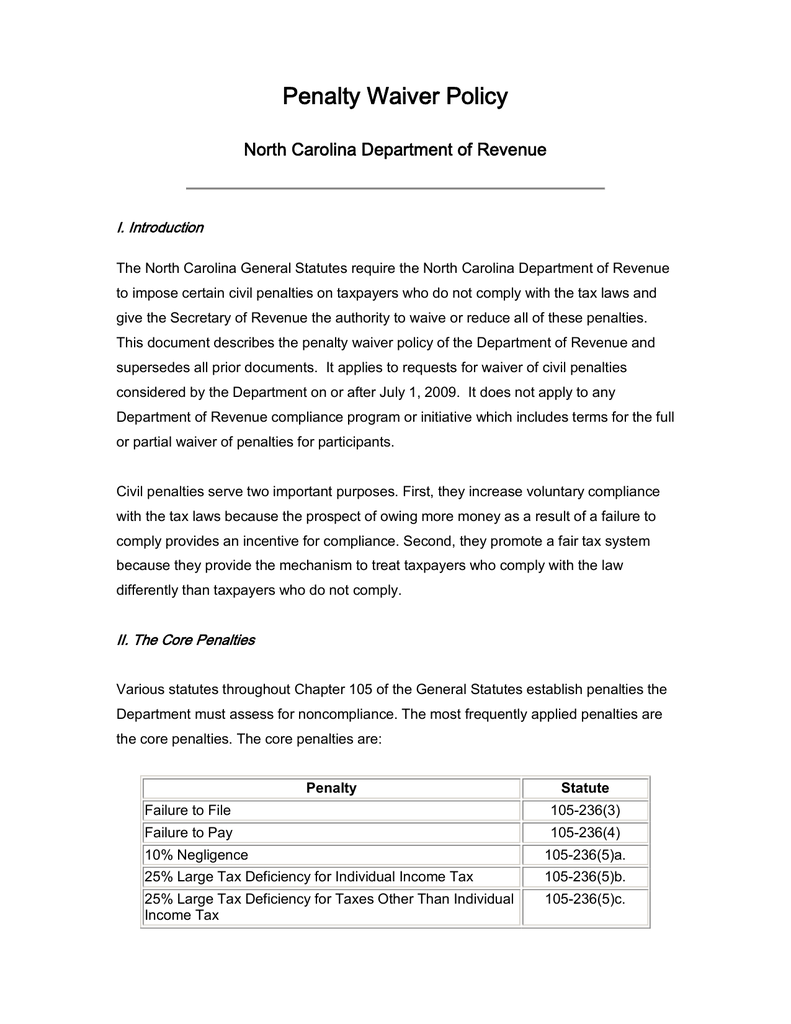

Penalty Waiver Policy North Carolina Department Of Revenue

Nj Inheritance Waiver Tax Form 01 Pdf Fill Online Printable Fillable Blank Pdffiller

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Tax Concerns For North Carolina Inheritances North Carolina Estate Planning Blog

Is There An Inheritance Tax In Nc An In Depth Inheritance Q A

Federal Gift Tax Vs California Inheritance Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

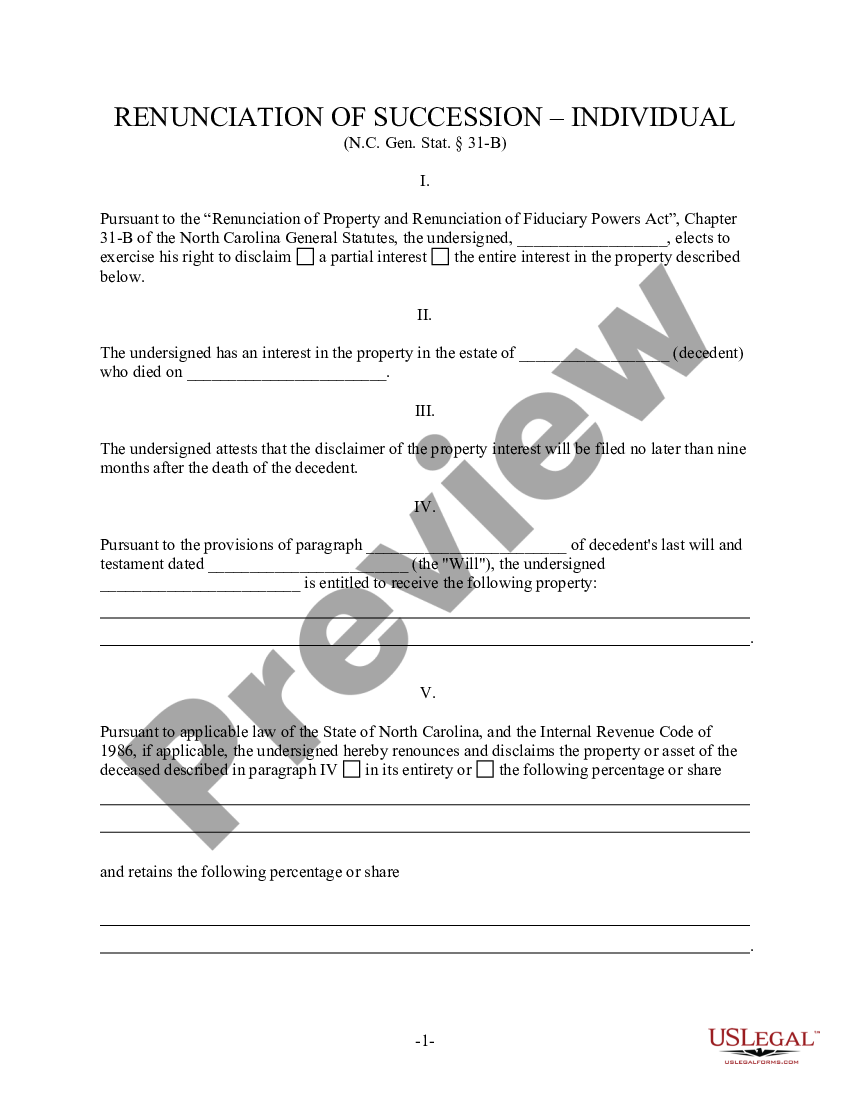

North Carolina Renunciation And Disclaimer Of Property From Will By Testate Renunciation Of Inheritance Form Us Legal Forms

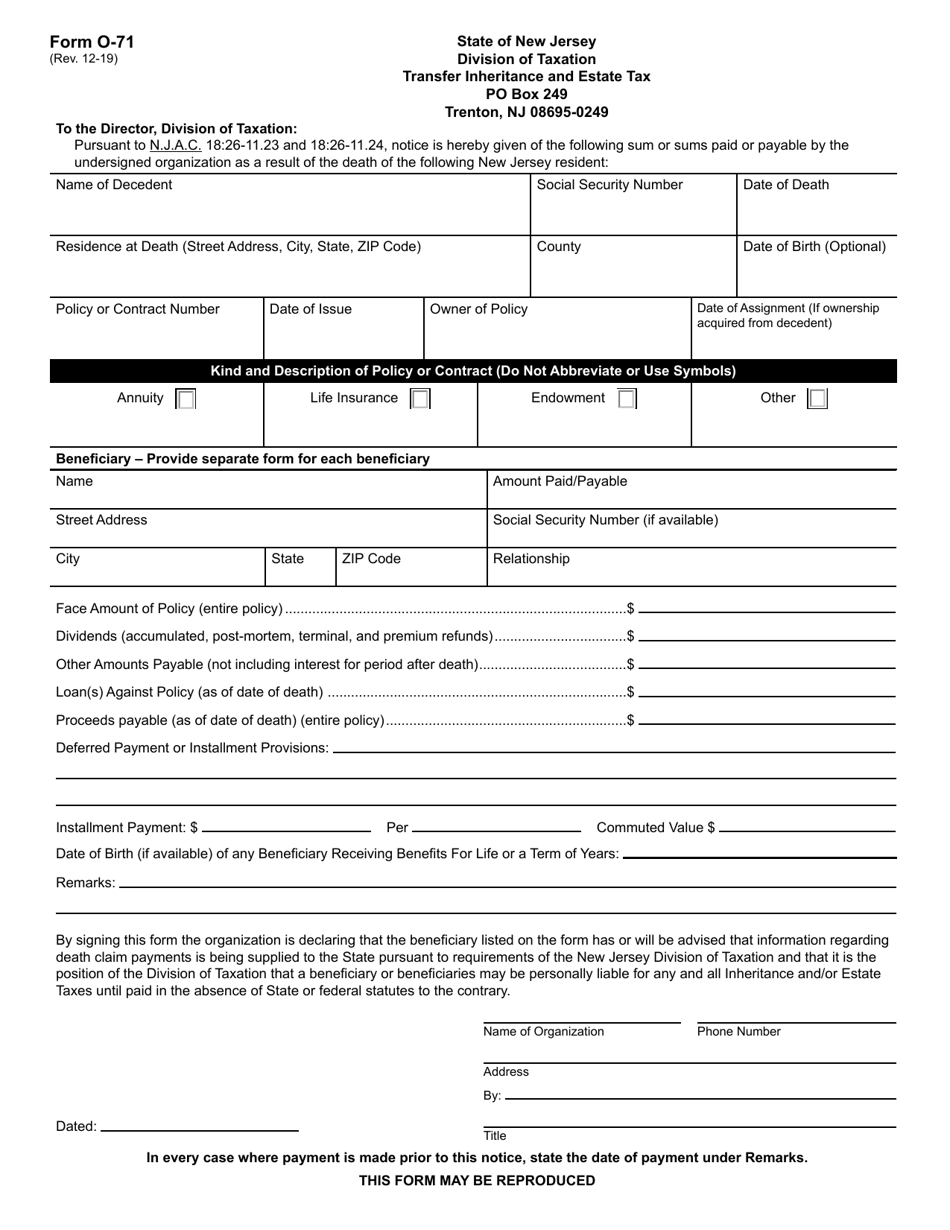

Form O 71 Download Fillable Pdf Or Fill Online Transfer Inheritance And Estate Tax New Jersey Templateroller

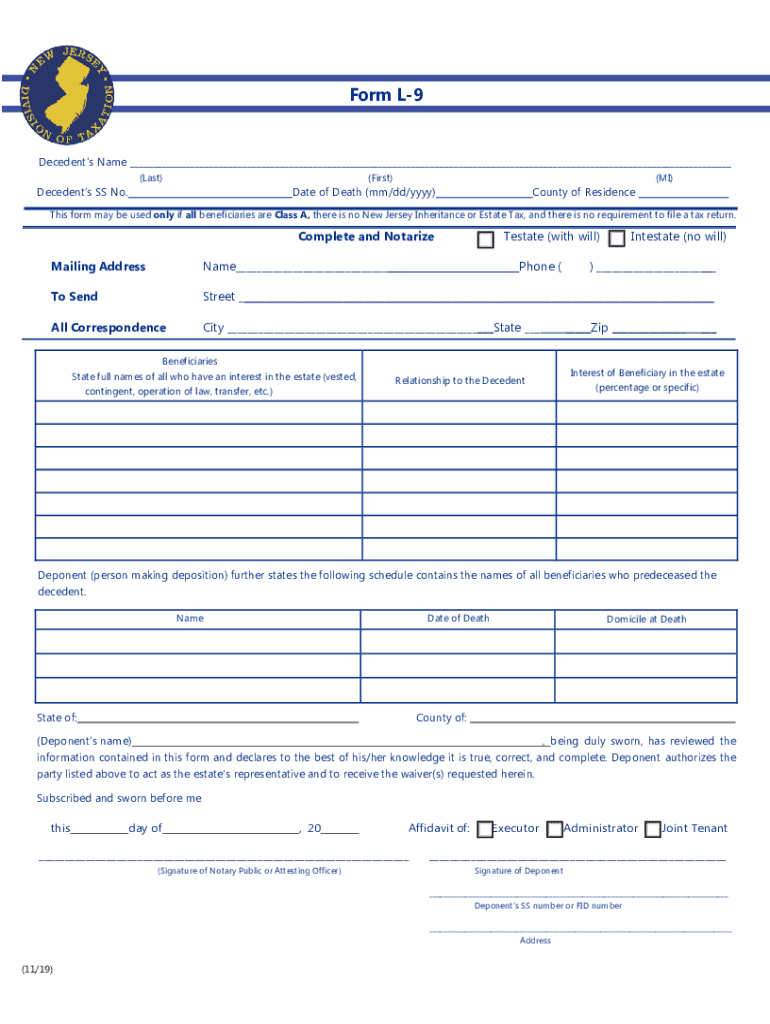

Nj Dot L 9 2019 2022 Fill Out Tax Template Online Us Legal Forms

North Carolina Renunciation And Disclaimer Of Property From Will By Testate Renunciation Of Inheritance Form Us Legal Forms

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

North Carolina Estate Tax Everything You Need To Know Smartasset

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

North Carolina Estate Tax Everything You Need To Know Smartasset

91 Direct Debit Form Template Page 4 Free To Edit Download Print Cocodoc